cash app taxes law

If you dont have our app yet simply download it on the Apple App Store or Google Play Store. People on social media are freaking out over claims that the Biden administration is setting new taxes on payment apps.

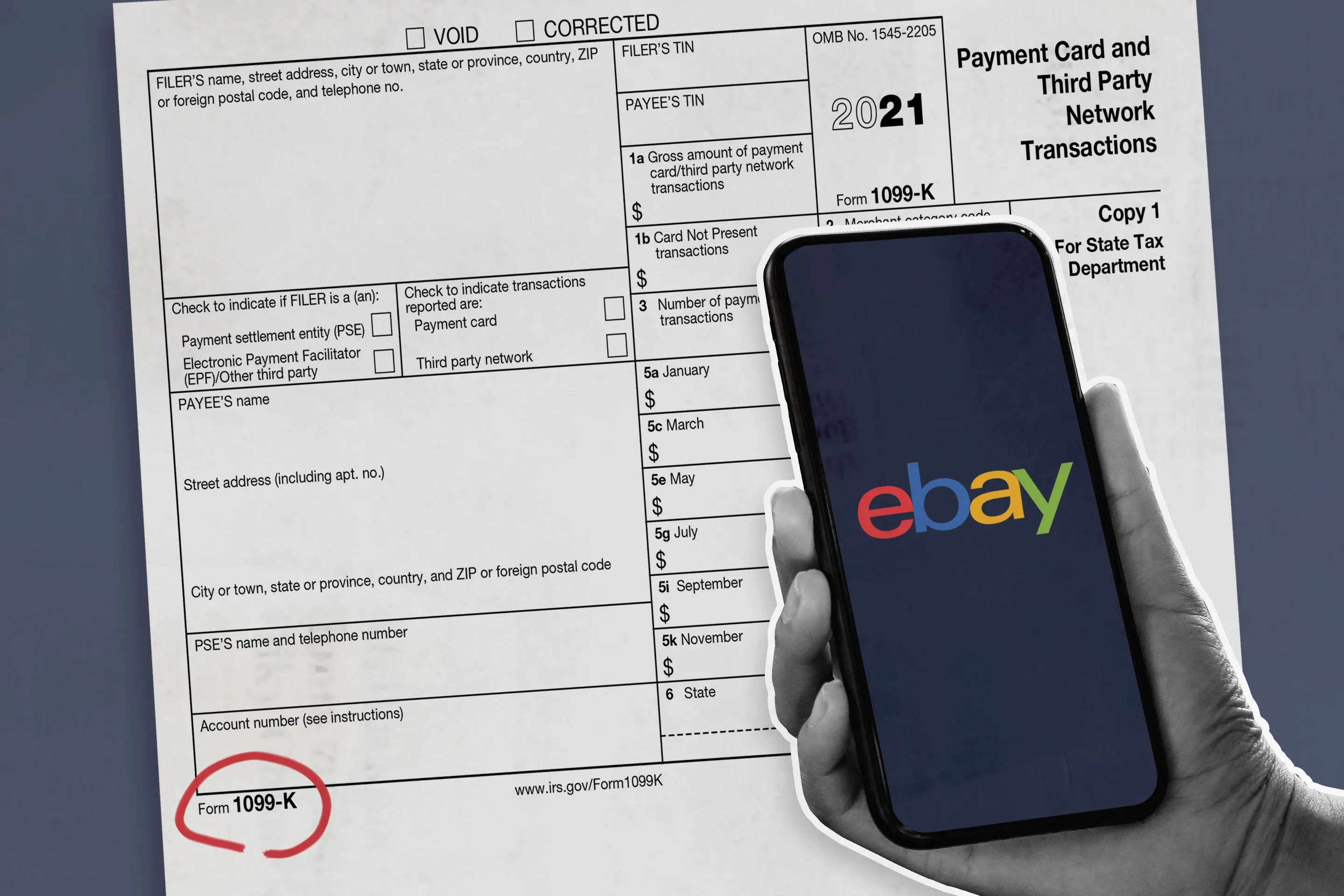

Yes you will likely receive a 1099-K form if you receive more than 600 on an app.

. Do I owe taxes on my cryptocurrencies. Rapid delivery firm Jokr raised 260 million in new financing from its investors giving the company fresh cash to expand its business across the US. Cash App Taxes formerly Credit Karma Tax is a fast easy 100 free way to file your federal and state taxes.

Loans to California residents are made or arranged pursuant to a California Finance Lenders Law License. You have to report any gains or losses on crypto sales including when you check out with crypto on your taxes. I have no records I paid cash is not an excuse as far as the ATO is concerned.

Budgets that are flush with cash after a year of record-setting surplusesThe influx of new money fueled by a quick economic recovery from the coronavirus pandemic and billions. 7 Upcoming Tax Law Changes. Before signing an installment agreement you should know that the law considers your signature an irrevocable admission that you owe all the taxes covered by the agreement.

Selling using or mining bitcoin or other cryptos can trigger bitcoin taxes. Youre probably familiar with all the different credit card companies offering cash back rewards or even those mail-in rebate offers you receive on certain goods. Earn cash back when you shop in the app.

An extension of the 300 deduction for cash charitable deductions if you claim the standard deduction. It is Cash App Taxes policy to terminate in appropriate circumstances account holders who repeatedly infringe or are believed to be repeatedly infringing the rights of copyright holders. Learn about Texas cash law for beer credit law for liquor the credit law delinquent list and who you should contact to submit notices and affidavits.

You can verify your profile using your drivers license passport or government-issued ID. Hello Im Scott from TurboTax with some information about how you should treat your cash back rewards for tax purposes. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied.

Special discount offers may not be valid for mobile in-app purchases. If you say that to them they will disallow your deductions. Updated for Tax Year 2021 December 23.

New users can follow the steps to register a profile with your email address. Plus weve added some new. This only applies for income that would normally be reported to the IRS anyway.

Your bank reports large withdrawals to the IRS and is required by law to do so. Positions taken on your return that are contrary to law. SQ has entered into a definitive agreement with Credit Karma to acquire its tax business Credit Karma Tax on behalf of Cash App.

Filing taxes is difficult. Now theres more ways to PayPal buy sell send receive and explore all in one place. Paying for something using cash.

When making a large withdrawal from your bank prepare to show identification and explain the reason for the withdrawal if it is for 10000 or more. Its a simple and secure way to get paid back for last nights takeout send money to friends who have an account with PayPal buy and checkout with crypto manage your bills and more. If you use cash apps like Venmo Zelle or PayPal for business transactions some changes are coming to what those apps report to IRS.

This Cash CentralCommunity Choice Financial 2021 Holiday Sweepstakes November 29 2021- December 5 2021 the Sweepstakes is open to persons who are 18 years of age or older at the time of entry 19 years of age in Alabama and are legal residents in the United States residing in one of the states in which the Sponsor provides. You may be sued. You may need to give the bank a few days to collect enough cash.

No cash value and void if transferred or where prohibited. Cash App Taxes respects copyright law and expects its users to do the same. Cash Rewards can be applied to purchases online at any club or in our mobile app or redeem them for cash at a register.

Having an item with a price tag attached but no evidence you purchased it. Multiply your rewards. Millions of people have trusted our service to file their taxes for free and customers rated it 48 out of 5 stars.

There isnt any new Cash App tax for 2022. If you have bought sold mined been airdropped or received cryptocurrency in exchange for work then you might owe taxes on your crypto. Form 1099-K is a.

Current tax law requires anyone to pay taxes on income over 600 regardless of where it comes from. Heres a guide to reporting income or capital gains tax on your cryptocurrency. Cash App does not provide tax advice.

What is the difference between short-term and long-term capital gains tax. The tax collectors last resort is to take a delinquent taxpayer to court. SAN DIEGO State lawmakers preparing to convene legislative sessions in the new year are confronted with a scenario unlike any they or most of their predecessors have ever experienced.

But that doesnt mean you owe any additional taxes. If you already have the Western Union app log in with Touch ID or your credentials. Cash App will provide you with your Form 1099-B based on the Form W-9 information you provided in the app.

In California budget officials expect to have a whopping 31 billion so much extra money that the state could be forced by existing law to give billions directly back to taxpayers. For Venmo Cash App and other users this may sound like a new taxbut its merely a tax reporting change to the existing tax law. Offer valid for returns filed 512020 - 5312020.

Members can also Cash Out at a register or save their rewards and allow them to Roll Over. Is a Georgia. It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App.

Primary and Complimentary cardholders can view status accrue redeem Cash Rewards.

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Irs Child Tax Credit Payments Start July 15

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Credit Karma Tax Is Now Cash App Taxes Forbes Advisor

Credit Karma Tax Is Now Cash App Taxes Forbes Advisor

Don T Believe The Hype Biden S 600 Tax Plan Won T Force You To Report All Venmo Transactions To The Irs Gobankingrates

Free Cash Payment Receipt Template Pdf Word Eforms

Taxes On Prize Winnings H R Block

Law Lets I R S Seize Accounts On Suspicion No Crime Required The New York Times

Can Cash App Transactions Be Traced By The Irs And Police How To Track Your Cash App Card

Who Goes To Prison For Tax Evasion H R Block

Why Does Cash App Need My Ssn And Id Use Cash App Without Ssn

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Montgomery County Child Care Resource Referral Center Home Facebook

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules